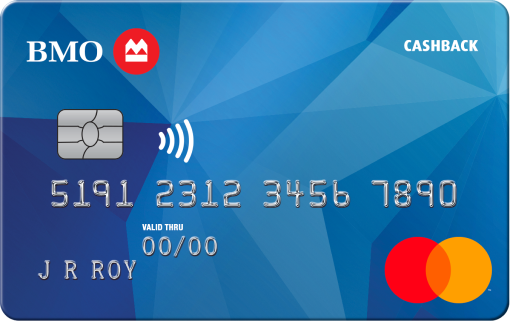

The Student BMO CashBack Mastercard credit card is ideal for students who value keeping track of their budget and maximizing their spending power, while establishing a credit history. All of that in a very user-friendly and safe digital banking platform.

And even better, it allows you to get cashback rewards on your everyday expenses – like groceries and dining out – without having to pay extra for it, once it has no annual fee, so it makes your spending more rewarding. Whether you’re purchasing textbooks or hanging out with friends, it is tailored to your lifestyle and helps you reach your financial goals. On top of that, you have a safe paying method for online shopping.

Key Features

- No Annual Fee;

- International Coverage;

- Welcome Offer: get up to 5% cash back in your first 3 months;

- Earn 3% cashback on grocery purchases;

- Earn 2% cashback on recurring bill payments such as mobile phones, streaming services, or subscriptions;

- Earn 0.5% cashback on all other purchases;

- Flexible and Simple Redemption: redeem your cashback when you want, for how much you want, get your cashback when you’ve reached a recurring set amount or as one-time lump sum, deposit your cashback into a BMO account (chequing, savings or InvestorLine) or get a statement credit;

- Get free, 24/7 access to CreditView with no impact to your credit score;

- Stay on top of your spending with a personalized look at your money;

- Extended warranty and purchase protection;

- Save up to 20% on National Car Rental and Alamo Rent A Car and up to 5% on Enterprise Rent-A-Car at locations worldwide using the Car Rental Booking tool;

- Grab a show with 20% off admission to Cirque du Soleil shows touring Canada, and 15% off resident shows in Las Vegas;

- Save up to 7% on your Booking.com prepaid hotel or property rental bookings at booking.com/mastercardcanada;

- Add another cardholder at no extra cost;

- Zero Liability Insurance;

- Mastercard Identity Check;

- BMO Alerts;

- Add-ons: BMO Credit Card Balance Protection and/or BMO Roadside Assistance.

Fees and Charges

- Annual Interest Rate:

- Purchases: 20.99%

- Cash Advances: 22,99% Non Quebec | 21,99% Quebec

- Balance Transfers: 22,99% Non Quebec | 21,99% Quebec

- Foreign Transaction Fee: 2,5%

Why Should You Choose The Student BMO CashBack Mastercard Credit Card?

This card stands out for its simplicity and impressive cashback rewards program for a student card, that focus on their major expenses, making it perfect for young adults managing their finances for the first time. One of the primary reasons to choose this card is the generous 3% cashback on groceries, besides the 1% cashback on recurring bill payments and 0.5% on all other purchases, which ensures that every transaction contributes to savings.

The card also comes with no annual fee and offers discounts that can add value to a student’s lifestyle, which is a crucial factor for budget-conscious students. Furthermore, it includes purchase protection and extended warranty coverage, providing peace of mind. On top of that it has an easy-to-use mobile app, allowing students to manage their spending and rewards effortlessly, while building their credit history and enjoying benefits tailored to their lifestyle needs.

How To Apply To The Student BMO CashBack Mastercard Credit Card

In order to be eligible, you need is to be at least the age of majority, a student, a Canada resident, and have not declared bankruptcy in the last 7 years. Here’s how to apply:

- Visit the Website: click on the button below to access the website. Then, click on the “Apply Now” option;

- Fill The Application Form: provide any personal and financial details requested and submit the form, in case you are not a BMO client yet;

- Wait for Approval: after submitting, wait for approval.

Easy Approval

Easy Approval